Digital and Value Creation: Where Do European Banks Stand?

PARIS, January 26, 2022 /PRNewswire/ -- As traditional banks have been increasingly focusing on digital to help curb customer drain to neobanks, digital performance must also be assessed in terms of value creation. This includes better retention by improving the experience through on digital channels, as well as expanding banking and insurance products available through said channels to help grow NBI. Digital performance rating agency D-Rating’s 2022 “Digital Proposal” stream shows that the this issue is already driving stakeholders.

The Digital Proposition is the first of three areas D-Rating assesses to rate the digital performance of the banks it studies. It includes nearly 400 metrics related to customer journeys, contact channels, mobile app and web features, and clients’ ability to access value-added banking offers.

Focus on overall results

The year 2022 saw the fifth such annual assessment of nearly 100 European banks —traditional banks, historic digital banks and neo-banks—mainly based in Germany, Belgium, France, Italy, Spain, the United Kingdom, Sweden, the Netherlands, Portugal and Poland.

Best national performance among banks assessed

| Country | Best performer | Topics explaining performance compared to local competitors |

|---|---|---|

| Germany | Consorsbank | Offers accessible through the mobile app, features on the web, instant and expert customer support. |

| Belgium | KBC Bank | Offers accessible on the web and on the mobile app, features on the web and on the mobile app, account opening, transfers. |

| France | Boursorama | Offers accessible through the mobile app, online and mobile app features, instant customer support, transfers. |

| Italy | Illimity bank | Offers accessible through the mobile app, features on the web, account opening, expert customer support, transfers. |

| Spain | BBVA | Offers accessible on the web, features on the web and on the mobile app, account opening, transfers. |

| United Kingdom | Revolut | Mobile app features, account opening, instant customer support. |

| Sweden | Nordea | Offers accessible on the web, features on the web and on the mobile app, appointment scheduling, expert customer support, transfers. |

| Netherlands | Rabobank | Offers accessible on the web and through the mobile app, features on the web. |

| Portugal | Novo Banco | Features on the web and on the mobile app, account opening, appointment scheduling, expert customer support. |

| Poland | ING Bank Śląski | Features on the web and on the mobile app, account opening, appointment scheduling. |

The possibility of opening an account through a fully digital journey has become the norm in Europe.

Fewer than 10% of the banks assessed don’t offer a digital option for opening accounts, and 6% still require visiting and/or calling a branch to complete the process. Conversely, 84% of banks offer an entirely digital journey.

In addition, as mobile apps fast becoming the main link between customers and their banks, the former can now open their accounts through said apps at 48% of the banks assessed (in Poland and Benelux, in particular). Some players, like KBC or Intesa Sanpaolo, even allow potential customers to try out the mobile app with an account linked to another bank before making the switch.

European banks: “better” digital, not just “more” digital.

In terms of basic offers, for example, banks have begun offering customers the option of signing up for bank cards via their mobile app (68% of banks assessed) and opening to Junior/Family accounts—a great way to indirectly capture young customers (23%).

As for more committing products, customers can sign e-contracts on secured online sites in 84% of cases to open a savings account, 69% for a personal loan and 68% for home insurance.1

Moreover, start subscription through a mobile app is possible in 85% of cases for savings accounts, 60% for personal loans and 67% for home insurance.1

The analysis also takes into account available tools to prepare an operation (e.g., simulators, estimates, dedicated contact channels) for various types of banking products.

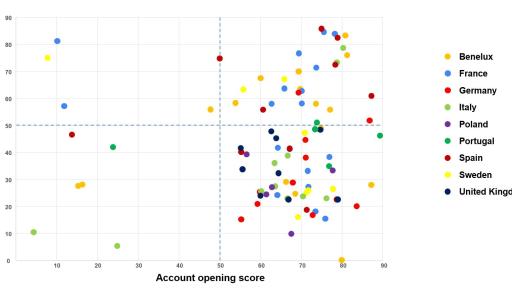

Ultimately, the Digital Proposition’s assessment positions the various players based on their performance in terms of attraction (account opening score) and products digital offering (access to offering score).

D-Rating believes that creating value through digital means will evolve significantly in the coming months, and traditional banks or first-generation online banks may be in a more favourable position than neo-banks, which have long focused on attracting new customers.

That said, the agency also feels that banks will seek to expand the hybridization of their account opening journey to increase cross selling in involving advisors (in branch, but also remotely by phone or videoconferencing).

Detailed charts: Germany, Belgium, France, Italy, Spain, United Kingdom, Sweden, Netherlands, Portugal, Poland

Analyzing the 2021 results will help distinguish groups whose strategy has already translated into NBI growth.

To access the full version of the press release, feel free to visit our website: https://www.d-rating.com/articles !

[1] For banks offering this product

Contact: [email protected]