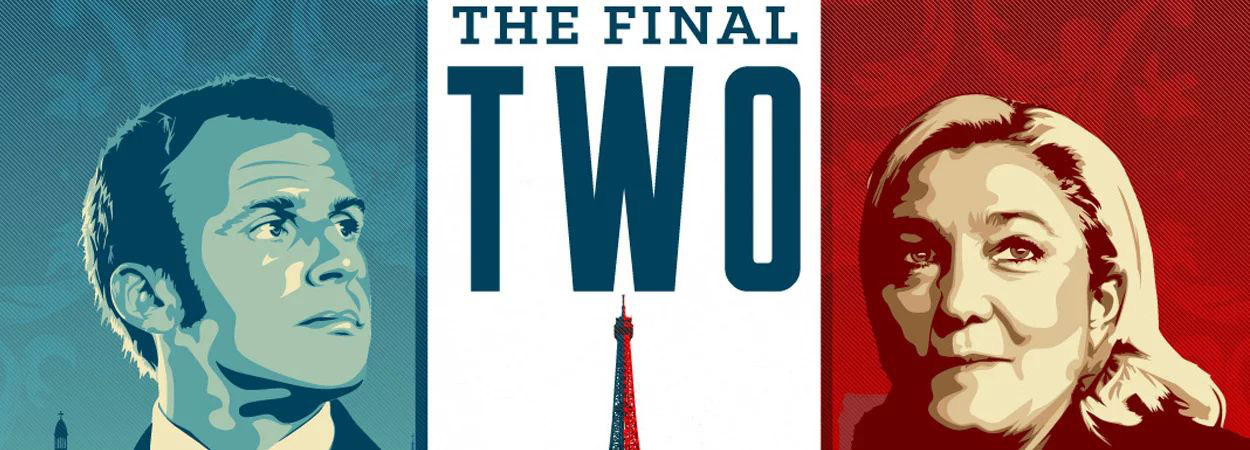

French election, round two: Swissquote helps investors optimize portfolios based on a Macron or Le Pen victory

- Investors can choose currency or stock baskets likely to benefit from either candidate’s victory

- Social Media Opinion Index helps investors gauge voter sentiment pointing to a possible winner

- Index is complemented by Swissquote analysts’ comments and trading tools that enable investors to trade on possible outcomes

Gland, Switzerland, May 02, 2017 – Swissquote Bank Ltd., Switzerland’s leading online bank, announces the launch of investment options based on the possible victory of either candidate in the upcoming second round of the French presidential election. Investors can choose among baskets filled with stocks, indices and currencies, optimized for one of the two outcomes.

The stocks, indices and currencies in the two Macron baskets are expected to rise following a Macron victory; those in the Le Pen baskets would gain value with a Le Pen victory.

In order to make the best-informed decisions, investors are given access to a unique tool developed in cooperation with the Social Media Lab at École polytechnique fédérale de Lausanne (EPFL): the Social Media Opinion Index, which provides real-time poll data on the election’s likely outcome, based on opinions about the two candidates expressed on social media networks.

The Macron stocks basket is most likely to benefit from the candidate’s support for stronger European integration, and openness to international trade. It includes several bank stocks, for example. The financial markets basket tied to Macron would increase in value as a result of a strengthened euro, and relatively weakened U.S. dollar and Swiss franc.

The Le Pen stocks basket is likely to benefit from the candidate’s protectionist policies, favoring French companies focused on domestic business. It also includes shares in companies which make most of their sales outside of the EU. The financial markets basket linked to Le Pen would likely benefit from a weakened euro, declines in French and German stock markets, and a strengthened Swiss franc.

“We are providing investors with key information to better understand the impact of the French election on the financial markets. With our baskets tailored to Macron and Le Pen, we help them benefit from changes related to a victory for either candidate both on equity and currency markets,” said Peter Rosenstreich, Head of Market Strategy at Swissquote.

The Social Media Opinion Index and investment baskets are available publicly on a dedicated Swissquote website: www.swissquote.com/french-election

Swissquote – The Swiss Leader in Online Banking

As a leading provider of online financial services, Swissquote offers innovative solutions and analysis tools to meet the wide range of demands and needs of its clients. As well as various online trading services, the user-friendly platform also provides solutions for eForex, ePrivate Banking and eMortgage. In addition to a low-cost service for private clients, Swissquote also offers specialized services for independent asset managers and corporate clients. Swissquote Bank Ltd holds a banking license issued by its supervisory authority the Swiss Federal Financial Market Supervisory Authority (FINMA) and is a member of the Swiss Bankers Association. Its mother company, Swissquote Group Holding Ltd, is listed on the SIX Swiss Exchange (symbol: SQN).

Download video and image content

For further information, please contact:

Nadja Keller

Swissquote Media Relations Manager

Tel: +41 44 825 88 01

[email protected]

Maria Diviney

Shepard Fox Communications

Tel: +44 2033 184491

Mobile: +44 7444 314547

[email protected]