Splitit Launches First B2B Credit Card Installment Payment Solution;

“Splitit Business Payments” Breaks Through Credit and Collection Barriers Between Suppliers and Buyers

NEW YORK, LONDON and SYDNEY, September 23, 2019 – Splitit Payments Ltd (ASX: SPT), a leading global monthly installment payments solution company, has launched “Splitit Business Payments,” a first of its kind innovative business-to-business (B2B) payment platform.

Splitit Business Payments enables manufacturers and suppliers to offer buyers of inventory or services an interest-free, installment credit solution utilizing their existing business credit cards. It addresses long-standing inefficiencies and friction in the way small-to-medium size buyers and sellers conduct business. It enables buyers to purchase goods and services with existing business credit cards for zero-interest transactions and delivers improved cash flow and guaranteed timely payments to suppliers.

“The $120 trillion B2B payments market has suffered from a lack of innovation for decades,” said Gil Don, CEO and co-founder of Splitit. “With Splitit’s patent portfolio for credit card-based transaction financing, we can finally get beyond antiquated invoices, purchase orders, credit verification, factoring, payment/collection systems and overstaffed accounts receivable departments.

“With Splitit Business Payments, we have created a simple yet highly effective solution that provides both suppliers and buyers with a flexible, frictionless payment option that can actually enhance their business relationships,” said Don.

How it Works

Splitit Business Payments is an extension of the company’s successful consumer installment payments platform which gives shoppers the ability to pay for purchases in interest-free monthly installments using their existing Visa or Mastercard accounts. Both B2C and B2B payment schemes are global in nature and can readily support cross-border transactions.

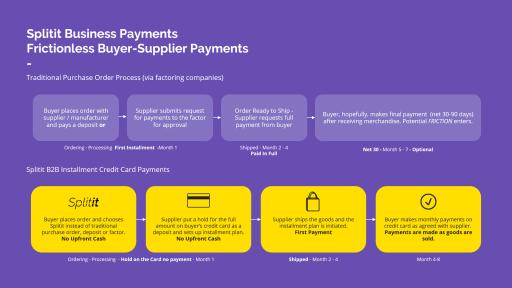

Once a buyer and a supplier agree on terms for an order, the buyer can choose Splitit Business Payments instead of a purchase order, making a deposit (often up to a third of the value of a contract) or working through a factor. The seller then puts a hold for the full amount of the order on the buyer’s business credit card in lieu of a deposit. Both sides agree to the terms of a monthly installment plan.

Based on mutual agreement, the manufacturer can process an initial payment or wait until the order is shipped. Once triggered, the installment plan is activated, and a first payment is automatically charged. At the same time, Splitit reduces the amount of hold on the credit card account by that amount. The entire process is risk-free to the supplier and continues automatically over the remaining months until the supplier is paid in full.

Buyers of goods and services are not required to submit an application, register or undergo a credit check, which translates to speedier and more efficient transactions. In addition, Splitit does not require them to sign a long-term contract.

Splitit Business Payments imposes no interest, charges no factoring fees and is more accessible than a conventional loan for B2B buyers. It also speeds and eases the reorder process.

Numerous Benefits for Buyers and Sellers

Splitit’s B2B payment solution minimizes supplier cash flow issues that often arise from expenses incurred during the traditional 60-day invoice period—including manufacturing, materials and payroll costs.

New York City-based Miz Mooz, which served as a beta customer for Splitit, is a shoe manufacturer creating quality and stylish women’s shoes at accessible prices using ethically sourced leather and working in family owned European factories. According to Miz Mooz President Ron Kenigsberg, his brand is now offering Splitit Business Payments to boutique and mom and pop shops to address their cash flow needs, many of whom are frequently stretched very thin.

“In the past, when a client orders $10,000 worth of shoes, we’ve used credit cards to have them prepay for goods that may take 30 to 90 days to sell. But, when we’re ready to ship, we sometimes receive calls from our clients asking for us to hold or split up the shipment into multiple parts so they can cover the cost of the goods. The problem is, it’s more work and expense for us to split up the shipment, hold the goods and then have repeat conversations about when to charge them and ship the next batch.

“Now, we can pre-authorize their credit, ship the entire order and provide securitized terms which removes the risk on our part and helps our merchants to have more time to sell the shoes – a better situation for both our company and our buyers.”

Ocean Rodeo, headquartered on Vancouver Island, British Columbia, Canada, is a kiteboarding, high adventure sports equipment provider which has been successfully using Splitit Business Payments to smooth cash flow by securing payment before shipping merchandise to retailers.

“Working with Splitit has been an excellent experience,” said John Zimmerman, president of Ocean Rodeo Sports. “The B2B offering has removed any inherent antagonism from our relationships with clients when it comes to debt collection and on-time payments, making the daily course of business with our customers smoother and more enjoyable, and allowing us to focus on growing sales and exploring new opportunities.”

E-commerce business intelligence company PipeCandy, with U.S. headquarters in Walnut, California (Eastern Los Angeles County) and in Chennai, India, started offering the Splitit B2B payment solution to its customers in September and sees it as a means to build its business, especially among the smaller, more resource-challenged companies in its customer base.

“We believe the Splitit B2B payment solution will be very popular with the 20 percent of our customers that are smaller companies for whom cash flow is crucial,” said Ashwin Ramasamy, co-founder and CMO of PipeCandy. “Our hope is that it will help us grow this segment of our business by 10 to 20 percent in the short term.”

“Splitit Business Payments creates a win-win situation for both sides of business transactions by removing burdensome credit expense and potential debt collection from the equation, speeding transactions and growing the businesses of both parties,” said Gil Levy, VP Global Marketing, Splitit.

A more complete rundown of benefits for both manufacturers/suppliers and retailers/ecommerce merchants can be viewed here.

“Splitit Business Payments creates a win-win situation for both sides of business transactions by removing burdensome credit expense and potential debt collection from the equation, speeding transactions and growing the businesses of both parties,” said Gil Levy, VP Global Marketing, Splitit.

For more information about Splitit Business Payments, visit http://www.splitit.com/business-payments or contact sales at [email protected].

About Splitit

Splitit is a payment method solution enabling consumers and businesses to pay for purchases with an existing credit card by splitting the cost into interest and fee-free monthly payments, without the need for additional registrations or applications. Splitit’s consumer solutions enable merchants to offer their customers an easy way to pay for purchases in monthly installments with instant approval, decreasing cart abandonment rates and increasing revenue. Splitit Business Payments allows manufacturers and suppliers to provide buyers with an interest-free, installment credit solution for purchasing goods and services utilizing their existing credit cards. Serving many of Internet Retailer’s top 500 merchants, Splitit’s global footprint extends to over 500 merchants in 27 countries around the world. Headquartered in New York, Splitit has an R&D center in Israel and offices in London and Australia.

Media Contact:

Rick Anderson / Doug Wright / Henry Feintuch

718-986-1596 / 212-808-4903 / 212-808-4901

[email protected]

Fintech innovation now moving to B2B payment market with Splitit’s new global Business Payments. Now, retailers and e-commerce stores can ease their cash flow concerns when buying goods from suppliers and manufacturers. #Splitit #B2B #fintech Tweet