SunTrust Mortgage: Kids Help Make the Pick in Half of Home Buying Decisions

Most popular requests are their own room and a large backyard

ATLANTA (May 21, 2018) – When it comes to purchasing a new home, 55 percent of U.S. homeowners with a child under the age of 18 at the time of home purchase say the opinion of their child was a factor in their home buying decision. This is according to a new Harris Poll survey commissioned by SunTrust Mortgage, a division of SunTrust Banks, Inc. (NYSE: STI). For millennial parents between the ages of 18 and 36, the influence of children is even higher at 74 percent.

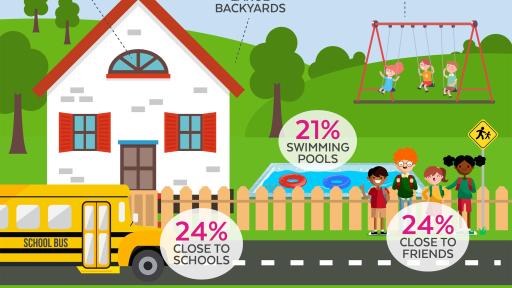

What are children lobbying for in a home? Top requests include their own bedrooms (57 percent); large backyards (34 percent); proximity to parks/activities (25 percent), schools (24 percent), friends (24 percent); and swimming pools (21 percent).

“As a parent of two kids, I know from experience that including children in the home buying process is not only fun for the whole family, but also educational for our homebuyers of tomorrow,” said Todd Chamberlain, head of Mortgage Banking at SunTrust. “Once the kids give a nod and the parents agree, SunTrust offers a simple way to apply for a mortgage online with SmartGUIDE ™, which cuts the time it takes to complete a typical mortgage application in half.”

55% of U.S. homebuyers say their children's opinion is a factor in home buying decisions, new survey from @SunTrust finds Tweet

Connect

SunTrust Tweets by SunTrustAmong renters with children under the age of 18, youngsters may play an even greater role in future home purchases. According to the survey, 83 percent of these renters said the opinion of their children will be a factor in which home to buy.

The survey also found that while 72 percent of renters want to purchase a home in the next two years, 17 percent said the stress of the mortgage application process is discouraging them. To help alleviate some of that stress, SunTrust suggests the following:

- Check your credit: Your credit score is an important factor when buying a home. Review your score with a mortgage loan officer to ensure you qualify for a mortgage, or put a plan in place to increase your score before applying.

- Know your budget: While you may have a good idea of the monthly payment you can handle each month, many people forget to consider hidden costs such as property taxes, homeowners insurance, utilities, repair and maintenance costs. Make sure you can afford the full cost of owning a home.

- Get your paperwork in order: Reduce your stress by having all of your files in order. Gather your W-2’s, recent pay stubs, tax returns from the past two years, and all of your checking and savings account balances before applying for a loan. Or, streamline the paperwork process by utilizing SunTrust’s SmartGUIDE ™ Mortgage Application, which allows consumers to upload the documents digitally.

- Understand how much money is needed for a down payment: While it certainly has its benefits in obtaining a better rate and avoiding certain mortgage insurance, you don’t always need to put 20 percent down to buy a home. In fact, most first-time homebuyers put much less than 20 percent down. Talk to your mortgage loan officer about the various options available.

- Don’t shop mortgages on interest rate alone: Interest rates are only part of the equation. Be sure to look at the full picture, including monthly payment and how closing costs will impact the money you need to bring to closing. One way to compare mortgage options is to look at the Annual Percentage Rate (APR), which factors in the costs of the loan for an apples-to-apples comparison.

For more home buying tips, visit www.suntrust.com/allabouthome.

This survey was conducted online within the United States by Harris Poll on behalf of SunTrust from April 18-20, 2018 among 2,047 U.S. adults ages 18 and older, among whom 1,303 are homeowners and 702 renters. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

About SunTrust Banks, Inc.

SunTrust Banks, Inc. is a purpose-driven company dedicated to Lighting the Way to Financial Well-Being for the people, businesses, and communities it serves. SunTrust leads onUp, a national movement inspiring Americans to build financial confidence. Headquartered in Atlanta, the Company has two business segments: Consumer and Wholesale. Its flagship subsidiary, SunTrust Bank, operates an extensive branch and ATM network throughout the high-growth Southeast and Mid-Atlantic states, along with 24-hour digital access. Certain business lines serve consumer, commercial, corporate, and institutional clients nationally. As of March 31, 2018, SunTrust had total assets of $205 billion and total deposits of $162 billion. The Company provides deposit, credit, trust, investment, mortgage, asset management, securities brokerage, and capital market services. Learn more at suntrust.com.

Contact: Angela Amberg

(404) 813-1885

[email protected]