Drivers unsure of how to prevent a collision with wildlife

New State Farm® Canada survey reveals a need for education around safe driving practices when faced with wildlife

Aurora, ON (Oct. 26, 2017) – A new national survey from State Farm Canada sheds light on how Canadians react to wildlife while driving.

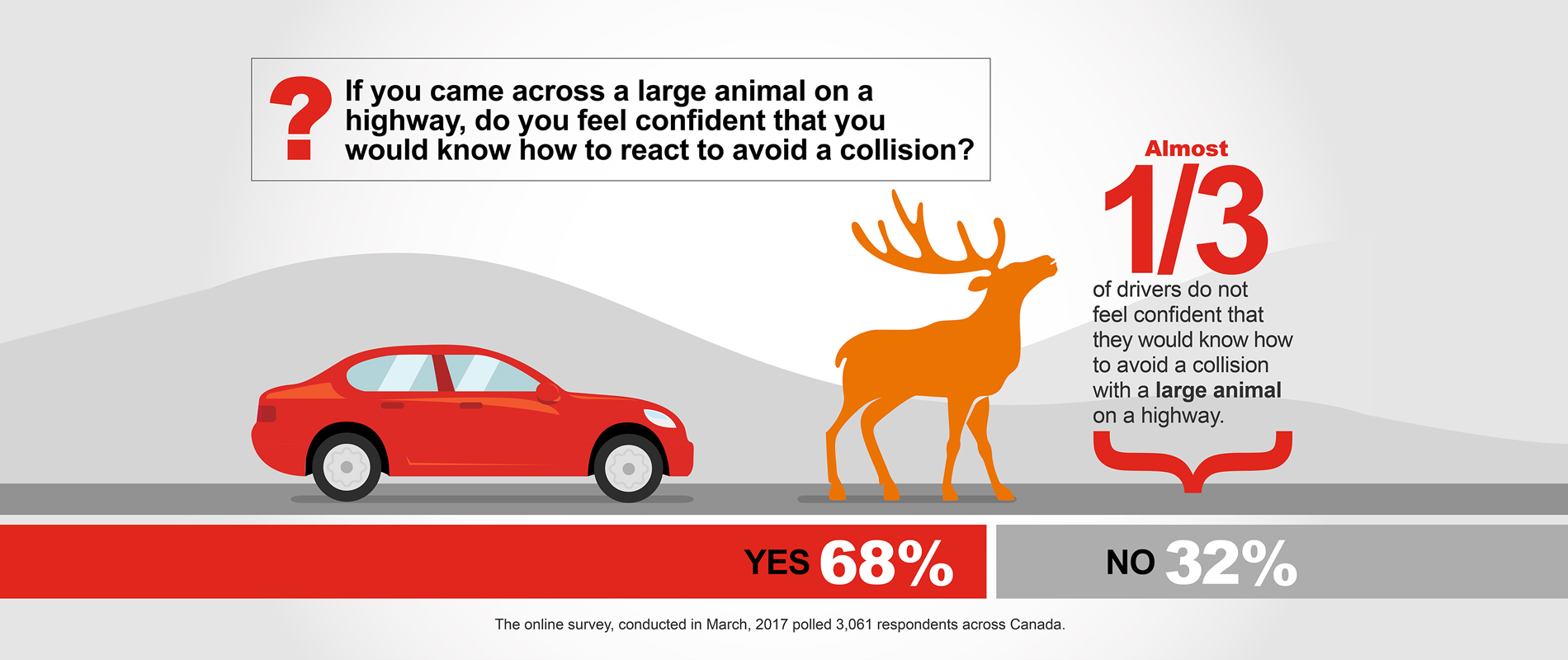

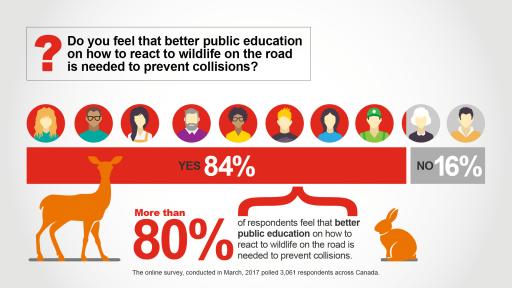

About 1 in 3 drivers do not feel confident that they would know how to avoid a collision with a large animal, and over 80 per cent believe that better public education about how to react to wildlife on the road is needed to prevent collisions that could lead to injuries and fatalities.

According to the survey, when seeing a deer in the middle of a two-lane highway, Canadians are most likely to brake (66 per cent) or take their foot off the gas (55 per cent). More than one-third indicated they would honk their horn and one-quarter said they would swerve.

“The unpredictability of these situations, combined with human impulses to try to preserve the lives of these animals makes these situations difficult and dangerous,” says John Bordignon, Media Relations, State Farm Canada. “In fact, according to police and road safety experts, swerving is not the best strategy when approaching wildlife on the road. Instead, they advise drivers to maintain their line, even if it’s toward the animal, and firmly apply the brakes. Swerving could send you into the path of an oncoming vehicle or cause you to lose control of your car.”*

More Education Needed

The survey indicates that Canadians want and need more education on how to deal with wildlife on our roads. The most likely time to encounter wildlife is at dusk or dawn, in October and November, on two-lane rural highways with speeds of 80 km/h or more1. From an insurance perspective the average auto damage claim after hitting an animal is $45002.

State Farm Canada’s long-time partner and road safety experts The Traffic Injury Research Foundation (TIRF) have developed an online information centre focused on road safety and wildlife. The Wildlife Roadsharing Resource Centre (WRRC) profiles tips on wildlife collision prevention, how to respond to animals on the road, tips for when a collision with wildlife is unavoidable and advice on what to do after a collision.** Specifically, TIRF has produced a fact sheet to address some of the common myths and misconceptions around wildlife vehicle collisions.

Fast Facts

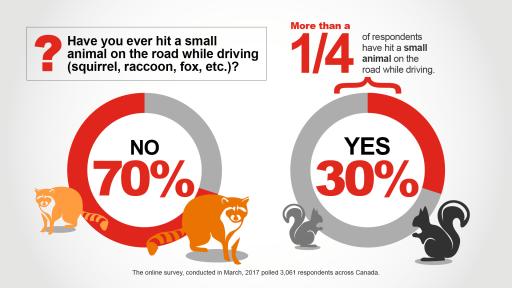

- More than 25 percent of survey respondents have hit a small animal on the road while driving

- More than 25 per cent have either hit or nearly hit a large animal while driving

- More than half of respondents who said they had hit a large animal had damage to their car

- More than 80 per cent of respondents claim they slow down when they see road signs for wildlife in the area

- Most respondents believe either evening (46 per cent) or night (36 per cent) is the most likely time to hit an animal on the road

Additional Resources

This is the final of three news releases State Farm will distribute in 2017 revealing survey results and the opinions of Canadians about their driving habits and road safety.

Infographic: http://www.multivu.com/players/English/8209251-state-farm-wildlife

To find out more about how State Farm works to improve road safety in Canada, please visit www.statefarm.ca/autosafety

About the Survey

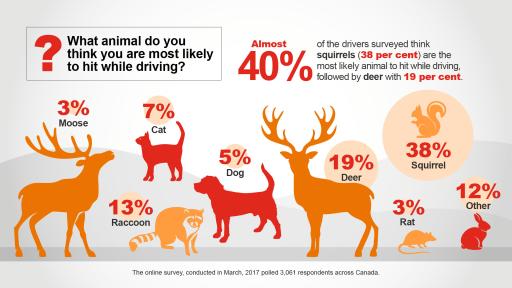

The online survey, conducted in March 2017, polled 3,061 respondents of driving age across Canada.

About the Traffic Injury Research Foundation (TIRF)

Established in 1964, TIRF’s mission is to reduce traffic-related deaths and injuries. As a national, independent, charitable road safety institute, TIRF designs, promotes, and implements effective programs and policies, based on sound research. TIRF is a registered charity and depends on grants, contracts, and donations to provide services for the public. Visit us online at www.tirf.ca.

About State Farm Canada

In January 2015, State Farm Canada operations were purchased by the Desjardins Group, the leading cooperative financial group in Canada and among the three largest P&C insurance providers in Canada. With approximately 500 dedicated agents and 1700 employees, the State Farm division provides insurance and financial services products including mutual funds, life insurance, vehicle loans, critical illness, disability, home and auto insurance to customers in Ontario, Alberta and New Brunswick. For more information, visit www.statefarm.ca, join us on Facebook – www.facebook.com/statefarmcanada – or follow us on Twitter – www.twitter.com/StateFarmCanada.

*This information is provided for informational purposes only. Neither State Farm nor Certas Home and Auto Insurance Company, nor any of its or their affiliates, shall be liable for any damages arising from any reliance upon such information or advice. Its is recommended that an expert be consulted for comprehensive, expert advice.

** Neither State Farm nor Certas Home and Auto Insurance Company, nor any of its or their affiliates is responsible for the contents of wildliferoadsharing.tirf.ca and make no warranties or representations about the contents, products or services offered on wildliferoadsharing.tirf.ca.

®State Farm and related trademarks and logos are registered trademarks owned by State Farm Mutual Automobile Insurance Company, used under licence by Certas Home and Auto Insurance Company.

©Copyright 2017, Certas Home and Auto Insurance Company.

1,2 Wildlife Roadsharing Resource Centre, Traffic Injury Research Foundation, http://wildliferoadsharing.tirf.ca/.

For more information, please contact:

Ginger Shewell

Media Profile

[email protected] / 416-342-1802

John Bordignon

State Farm Canada - Desjardins Group

[email protected]

905-750-1999 ext. 632-5567 / 416-801-6078