DaVita Medical Group Provides Important Tips and Considerations for Medicare Beneficiaries

DENVER (October 17, 2017) – DaVita Medical Group, a division of DaVita Inc. (NYSE: DVA) and a leading independent medical group in the United States, is encouraging Medicare beneficiaries to review their healthcare coverage during Medicare’s Open Enrollment Period (October 15 through December 7) to ensure they select a plan that will meet any changing health needs, allow them to see their preferred primary care physicians and specialists, and includes coverage of prescription medications.

“Open Enrollment is an important time for seniors to carefully evaluate their current benefits and consider any changes in their health to ensure they select the program to best meet their needs in 2018,” said Chan Chuang, MD, chief clinical officer at DaVita Medical Group. “Patients should make sure that they will be able to continue seeing the doctors of their choosing as participating physicians may change from year-to-year. We feel it’s important that eligible beneficiaries be proactive and not assume that their existing coverage will remain the same in 2018.”

.@DaVitaMedical Group provides tips for #Medicare Open Enrollment beneficiaries. Tweet

According to 2017 Deft Research (Medicare Age-In Study), the top reason for considering any plan is access to doctors, which is an increasingly important factor for patients.1 The seven-week Open Enrollment Period allows beneficiaries to reevaluate their existing coverage, including their health and prescription drug plans, recognizing that covered physicians, benefits and premiums may change from year-to-year.

“Healthcare coverage, including Medicare plans, are complex and can be not only frustrating, but often confusing, for even the savviest consumer,” said Dr. Chuang. “At DaVita Medical Group, we recommend that patients use their provider as another resource to help navigate this process.”

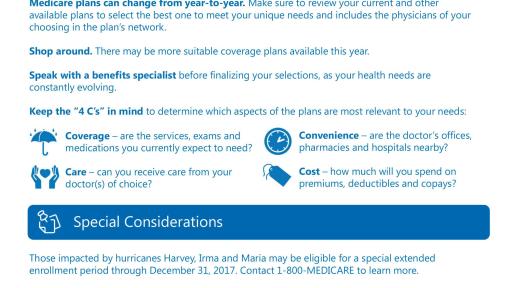

Beneficiaries should keep the following in mind during the open enrollment period:

Special Enrollment Period for those affected by Hurricanes Harvey, Irma and Maria. Individuals who reside in or move from areas affected by a hurricane in 2017 will be eligible for a special enrollment period that extends the 2018 Annual Open Enrollment Period through December 31, 2017. Individuals may contact 1-800-MEDICARE to request enrollment using this special enrollment opportunity.

Healthcare policy changes are to be expected. Consumers should know that while America’s legislators are considering changes to national healthcare policy, it is important to know that any legislation that is passed will take time to be implemented and will likely not impact Medicare coverage during 2018.

New Medicare cards are coming. In order to protect Medicare beneficiary identities, Medicare is issuing new cards between April 2018 and April 2019, which will have a new Medicare Number that’s unique to the individual, instead of their Social Security Number. The new Medicare cards will not change your coverage or benefits, and there is no charge for the new card.

Your health needs may have evolved. From year to year, it’s likely that your needs may change, whether you received a new diagnosis in 2017 or are expecting to need a specialist after speaking with your primary care physician. By assessing these changes, evaluating which physicians are in your network and anticipating needs in the upcoming year, you can ensure that you have the coverage you need and deserve.

Your plan may change. The coverage of your Medicare plan, from physicians and prescriptions to copays, may change each year, along with the plan’s premiums. To make sure that your plan meets your unique needs, medicare.gov recommends reviewing the materials that your plan sends you, such as “Evidence of Coverage” (EOC) and “Annual Notice of Change” (ANOC), and comparison shop with other Medicare plans who are competing for your business.

Better coverage may be available. Research shows that people with Medicare Part D (prescription drug coverage) can lower their costs by shopping among plans each year. In addition, certain plans offer benefits beyond standard Medicare. For example, Medicare Advantage Plans may offer additional benefits to its members, such as dental, vision, transportation services, cancer screenings or wellness visits.

Feel prepared before making any changes. Open enrollment brings along with it many options to choose from, which can make it confusing to compare plans and select the best option for you. You may want to consult a licensed financial advisor who specializes in Medicare programs to help you weigh your options. Regardless of whether you work with an advisor or not, keep the “4 C’s” in mind to determine what aspects of the plans will best meet your needs:

- Coverage – are the services, exams and medications you currently and expect to need included?

- Care – can you receive care from your doctor(s) of choice?

- Convenience – are the doctor’s offices, pharmacies and hospitals nearby?

- Cost – how much will you spend on premiums, deductibles and copays?

Overall the most important reason to review your Medicare plan is to make sure you’re getting the coverage you need and deserve. According to Pew Research, seniors are online multiple times per day and mobile connectivity is up to 42%2, which is why there are plenty of online resources available to help you through this process.

- HCPopenenrollment.com (HealthCare Partners - California)

- HCPNV.com/openenrollment (HealthCare Partners – Nevada)

- OEP.FL.davitamedicalgroup.com (DaVita Medical Group - Florida)

You can also visit www.medicare.gov or call 1.800.MEDICARE (1.800.633.4227) 24 hours a day, seven days a week.

About DaVita Medical Group

DaVita Medical Group is a division of DaVita Inc., a Fortune 500® company, that operates and manages medical groups and affiliated physician networks in California, Colorado, Florida, Nevada, New Mexico, Pennsylvania and Washington. A leading independent medical group in America, DaVita Medical Group has over two decades of experience providing coordinated, outcomes-based medical care in a cost-effective manner. DaVita Medical Group’s teammates, employed clinicians and affiliated clinicians provided care for approximately 1.7 million patients. For more information, please visit DaVitaMedicalGroup.com.

About DaVita Inc.

DaVita Inc., a Fortune 500® company, is the parent company of DaVita Kidney Care and DaVita Medical Group. DaVita Kidney Care is a leading provider of kidney care in the United States, delivering dialysis services to patients with chronic kidney failure and end stage renal disease. As of June 30, 2017, DaVita Kidney Care operated or provided administrative services at 2,445 outpatient dialysis centers located in the United States serving approximately 194,600 patients. The company also operated 217 outpatient dialysis centers located in 11 countries outside the United States. DaVita Medical Group manages and operates medical groups and affiliated physician networks in California, Colorado, Florida, Nevada, New Mexico, Pennsylvania and Washington in its pursuit to deliver excellent-quality health care in a dignified and compassionate manner. DaVita Medical Group’s teammates, employed clinicians and affiliated clinicians provided care for approximately 1.7 million patients. For more information, please visit DaVita.com/About.

Contact Information

Media:

Jessica Geurkink

(720) 925-3184

[email protected]

1 Deft 2017 Medicare Age-In Study

2 pewinternet.org “Tech Adoption Climbs Among Older Adults” May 2017