| Media Relations: | Investor Relations: |

|---|---|

| Anna Robinson | George Grofik |

| 908-989-0726 | 908-981-5560 |

| Email: [email protected] | Email: [email protected] |

Media Panel

Resources

Sanofi Announces Q2 2016 Results

Paris, July 29, 2016 / PRNewswire / — Sanofi (NYSE: SNY; EURONEXT: SAN)

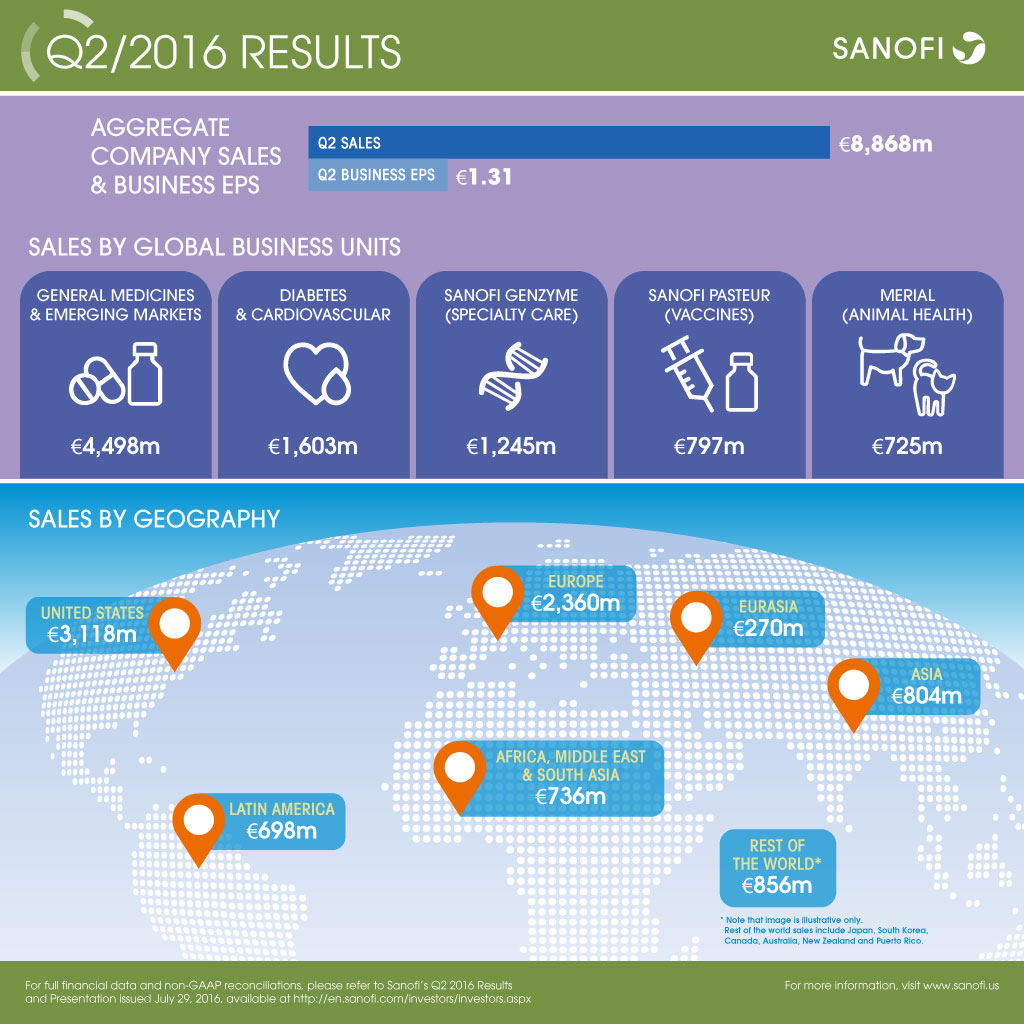

| Q2 2016 | Change | Change (CER) | |

| Aggregate Group sales(1) | €8,868m | -4.3% | -0.2% |

| Business net income(2) | €1,680m | -8.7% | -3.3% |

| Business EPS(3) | €1.31 | -7.1% | -2.1% |

(1) Including Merial (see Appendix 10 for definition of Aggregate Company sales) which is reported on a single line in the consolidated income statements in accordance with IFRS 5 (Non-current assets held for sale and discontinued operations). Additionally, Sanofi comments include Merial for every income statement line using the term “Aggregate”; (2) In order to facilitate an understanding of operational performance, Sanofi comments on the business net income statement. Business net income is a non-GAAP financial measure (see Appendix 10 for definitions). The consolidated income statement for Q2 2016 and H1 2016 is provided in Appendix 4 and a reconciliation of business net income to IFRS net income reported is set forth in Appendix 3; (3) (EPS) Earnings Per Share.

Sanofi Chief Executive Officer, Olivier Brandicourt, commented:

“Our second quarter financial performance was in-line with expectations despite anticipated headwinds. Sanofi Genzyme grew 20% and, although Dengvaxia® uptake has been delayed, Sanofi Pasteur performed well. Recent highlights included the signing of the CHC asset swap, the approval of Praluent® in several countries and positive Phase III CHRONOS data for dupilumab. Following our first half performance, we confirm our broadly stable 2016 Business EPS guidance at CER.”

Second quarter financial results and 2016 guidance confirmed

- Aggregate Company sales decreased 0.2% (down 4.3% at 2016 exchange rates) to €8,868 million. Excluding Venezuela, Aggregate Company sales grew 1.9%

- Business EPS was down 2.1% at CER to €1.31 and down 7.1% on a reported basis

- Sanofi continues to expect 2016 Business EPS to be broadly stable at CER, barring unforeseen major adverse events

Performance of Global Business Units (GBU) led by Sanofi Genzyme

- Strong double-digit growth of Sanofi Genzyme (+20.1%) across multiple sclerosis and rare disease franchises

- Sanofi Pasteur sales increased +6.3%, despite anticipated supply constraints of Pentacel® in the U.S.

- General Medicines & Emerging Markets sales declined 5.6%, or down 1.9% excluding Venezuela.

- Diabetes and Cardiovascular sales were down 3.5%. Global diabetes franchise sales declined 3.2%

- Animal Health sales were up 9.1% to €725 million, driven by the success of the NexGard® family of products

- Aggregate sales in Emerging Markets grew 6.7% excluding Venezuela

Major launches update

- Toujeo® generated worldwide sales of €141 million

- Praluent® launch advancing globally with approval in Japan and market share improvement in the U.S.

- Dengvaxia® uptake delayed by recent political changes and economic volatility in Latin America

Key R&D milestones achieved

- Positive CHRONOS data for dupilumab in atopic dermatitis

- Adlyxin™ (lixisenatide) approved in the U.S.

- FDA Advisory Committee recommended approval of LixiLan

R&D Update

Regulatory update

Regulatory updates since the publication of the first quarter results on April 29, 2016 include the following:

- In July, the Ministry of Health, Labor and Welfare in Japan granted marketing authorization for Praluent® (alirocumab) for the treatment of uncontrolled low-density lipoprotein cholesterol in certain adult patients with hypercholesterolemia at high cardiovascular risk. The 300mg once-monthly dosing of Praluent® was also filed in U.S. and EU.

- In July, the file for the Marketing Authorization Application for sarilumab in Rheumatoid Arthritis was accepted for review by the European Medicines Agency (EMA).

- In May, the Endocrinologic and Metabolic Drugs Advisory Committee (EMDAC) of the FDA recommended the approval(4) of the New Drug Application (NDA) for Adlyxin® (lixisenatide) and for the fixed-ratio combination of basal insulin glargine 100 Units/mL and GLP-1 receptor agonist lixisenatide for the treatment of adults with type 2 diabetes. The fixed-ratio combination of basal insulin glargine and GLP-1 receptor agonist lixisenatide is undergoing FDA review, with decisions anticipated in August 2016. Adlyxin® (lixisenatide) was approved in the U.S. at the end of July.

(4) The members of the Advisory Committee voted 12-2 for an approval of LixiLan

At the end of July 2016, the R&D pipeline contained 44 pharmaceutical new molecular entities (excluding Life Cycle Management) and vaccine candidates in clinical development of which 14 are in Phase III or have been submitted to the regulatory authorities for approval.

Portfolio update

Phase III:

- In June, the results of the pivotal Phase III LixiLan-O and LixiLan-L clinical trials with the investigational titratable fixed-ratio combination of basal insulin glargine 100 Units/mL and lixisenatide in adults with type 2 diabetes were presented at the American Diabetes Association Scientific Sessions. Both studies met their primary endpoints, demonstrating statistically superior reduction of HbA1c with the titratable fixed-ratio combination versus comparators (lixisenatide and insulin glargine 100 Units/mL, respectively).

- In June, Sanofi and Regeneron announced that a one-year Phase III study, known as LIBERTY AD CHRONOS, evaluating investigational dupilumab met its primary and key secondary endpoints. In the study, dupilumab with topical corticosteroids (TCS) was compared to TCS alone in moderate-to-severe atopic dermatitis adult patients. Patients enrolled in the study were inadequately controlled by TCS with or without topical calcineurin inhibitor. Dupilumab with TCS significantly improved measures of overall disease severity at 16 and 52 weeks, when compared to placebo with TCS.

- Based on the results of the FIRSTANA Phase III study comparing Jevtana® (cabazitaxel) versus Taxotere® (docetaxel) in chemotherapy-naïve metastatic castration resistant prostate cancer, the decision was made not to submit a first line indication for Jevtana® as the results did not provide the level of benefit that is needed for claiming new indication. Jevtana® currently has a second line indication and FIRSTANA was conducted as part of the post marketing commitment with the FDA.

Phase II:

- SAR439684, a PD-1 inhibitor (alliance with Regeneron), entered Phase II in advanced cutaneous squamous cell carcinoma.

Phase I:

- It has been decided not to pursue the development of SAR438544, a stable glucagon analog, in diabetes.

To access the full press release of the 2016 Q2 results, please click here.

2016 guidance

Sanofi continues to expect 2016 Business EPS to be broadly stable at CER, barring unforeseen major adverse events. In addition, the currency impact on 2016 full-year business EPS is estimated to be around -4%, applying June 2016 average rates to the two remaining quarters of 2016.

Forward-Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are statements that are not historical facts. These statements include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans” and similar expressions. Although Sanofi’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Sanofi, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include among other things, the uncertainties inherent in research and development, future clinical data and analysis, including post marketing, decisions by regulatory authorities, such as the FDA or the EMA, regarding whether and when to approve any drug, device or biological application that may be filed for any such product candidates as well as their decisions regarding labelling and other matters that could affect the availability or commercial potential of such product candidates, the absence of guarantee that the product candidates if approved will be commercially successful, the future approval and commercial success of therapeutic alternatives, Sanofi’s ability to benefit from external growth opportunities and/or obtain regulatory clearances, risks associated with intellectual property and any related pending or future litigation and the ultimate outcome of such litigation, trends in exchange rates and prevailing interest rates, volatile economic conditions, the impact of cost containment initiatives and subsequent changes thereto, the average number of shares outstanding as well as those discussed or identified in the public filings with the SEC and the AMF made by Sanofi, including those listed under “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in Sanofi’s annual report on Form 20-F for the year ended December 31, 2015. Other than as required by applicable law, Sanofi does not undertake any obligation to update or revise any forward-looking information or statements.