A Historical Look at Vehicle Theft in the United States

Technology and Teamwork Drive Dramatic Reductions

A Historical Look at #VehicleTheft in the United States from @insurancecrime Tweet

Over the years, the single-vehicle family–long the norm in America–became the exception as it gave way to families with multiple vehicles. In 1960, there were 74,159,209 vehicles registered across the nation whose population that year was 180,671,158. Registrations as a percentage of that population stood at 41 percent. In 2012, that figure increased to 80.8 percent as registrations climbed to 253,639,386 distributed within the nation’s 313,873,685 in population.

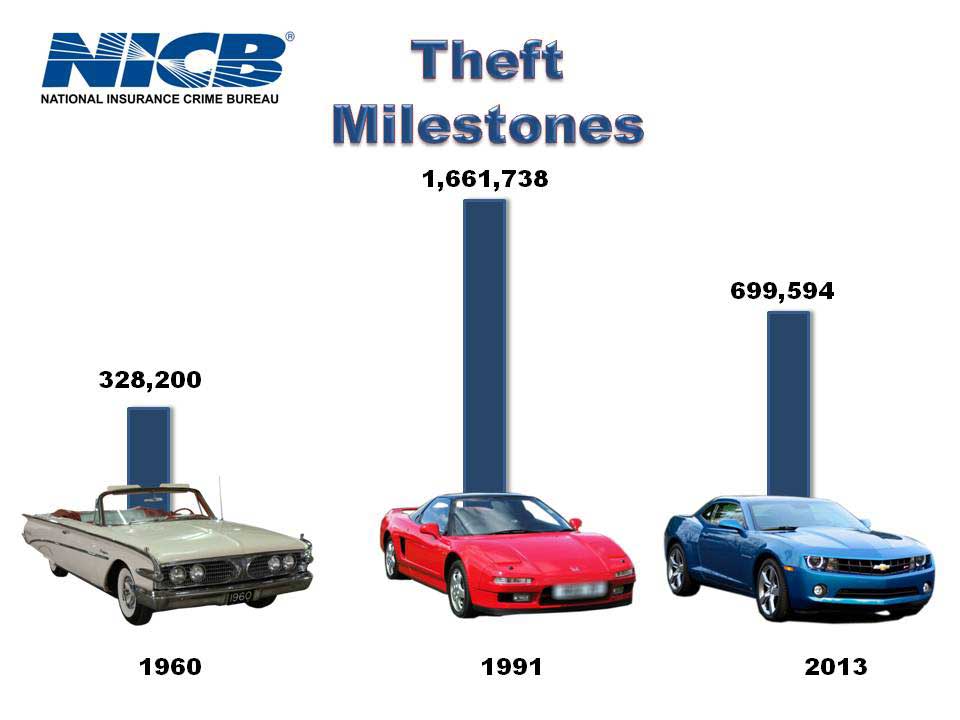

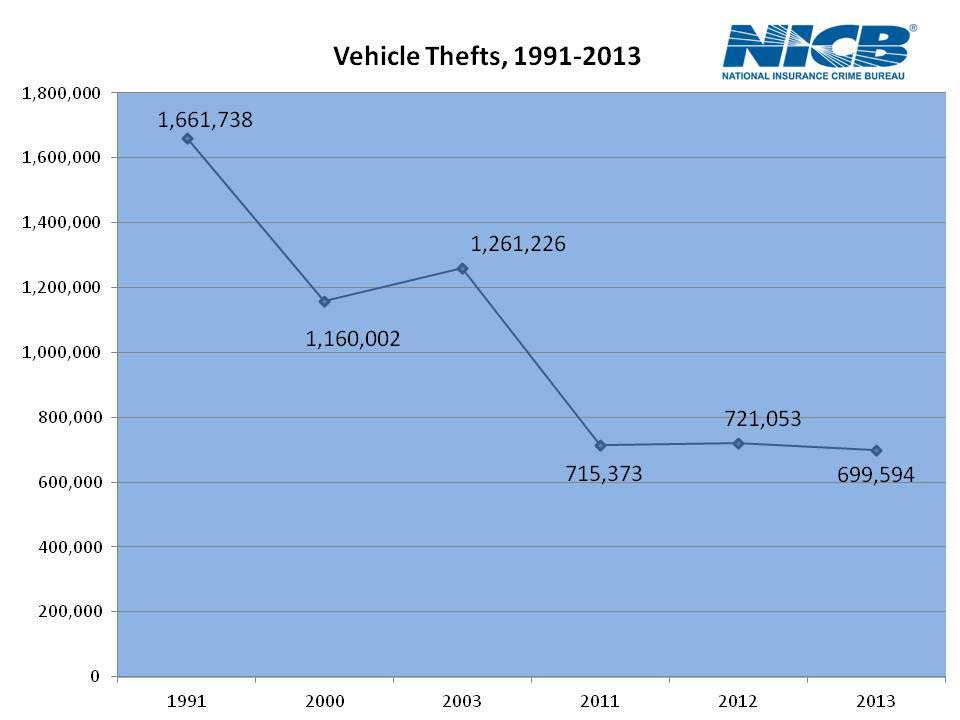

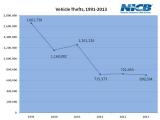

As vehicles rose in numbers across America, they also attracted the attention of the nation’s vehicle thieves. In 1960, there were 328,200 vehicle thefts. In 1991–the peak year–there were 1,661,738 vehicle thefts and the theft rate was 659.01 per 100,000 population. In 2013, despite an increase in population and registrations of over 60 million, thefts were down to 699,594 with a theft rate of 221.3–a decrease of 437.71.

Download all the historical data and analysis here, including individual state rankings and a top 10 list of the states with the highest annual vehicle theft numbers.

For a video report, click here.

What does all this mean to everyday people?

It means that if you own a vehicle, your chances of having it stolen today are statistically and significantly less than at any other time since 1960. A recent poll by the Gallup organization makes that point more precisely, as it found that 56 percent of Americans rarely or never worry about their cars being stolen.

Over the years, auto theft was so pervasive in many areas that local law enforcement agencies created specialized auto theft investigative units to deal with the problem. Still, preventing auto theft in the first place has always been the challenge. But like any crime, once it occurs, the focus for law enforcement shifts from prevention to resolution and with auto theft, typically that meant recovering the vehicle. The best outcome was the “Triple Play”–recovering the vehicle, arresting the thief and getting him convicted.

The rise in vehicle thefts led to the creation of many auto theft prevention authorities (ATPA)–statewide entities comprised of seasoned investigators and funded, in most cases, by surcharges on auto insurance policies. Today, there are 14 ATPAs in existence.

A dramatic and sustained reduction.

From their peak year in 1991, vehicle thefts have trended downward. From 1991 through 2000, there was a 30 percent decline. From 2000 through 2003, thefts rose a little before falling precipitously and consecutively each year from 2004 through 2011–43 percent in eight years.

In 2012, thefts increased slightly before falling again in 2013 to levels not seen since 1967.

What delivered such results?

There are lots of factors that have combined to produce such impressive results beginning with law enforcement efforts that developed innovative investigative processes. These techniques were then shared across law enforcement communities, and with associations of public and private organizations like the International Association of Auto Theft Investigators (IAATI) and the International Association of Special Investigation Units (IASIU).

Moreover, the insurance industry-supported National Automobile Theft Bureau, predecessor to NICB, was home of the most experienced auto theft investigators dating back to 1912. NATB/NICB has trained thousands of local, state and federal law enforcement officers over its 102-year existence, and today has special agents working alongside their law enforcement counterparts in most major cities across the country.

That collaboration and coordination has been critical in attacking the vehicle theft problem, and the relationships created in those environments have helped maintain impressive investigative results despite the reduction in law enforcement staffing brought about by the Great Recession over the last several years. Those relationships were mature and effective enough to exploit the single most important development in the vehicle theft prevention and investigation–technology.

Technology has had an immeasurable positive effect on vehicle theft whether it’s deployed in the auto manufacturing process as new and more reliable anti-theft protection is engineered into design, or obtained as an after-market option by vehicle owners looking for an additional level of security. Put simply, cars are just more difficult to steal today than ever before and technology has made that possible.

Technology is also law enforcement’s great equalizer, as well. Everything from remote surveillance cameras to automated license plate readers to “bait cars”–technology is a force multiplier that never calls in sick and produces results around the clock.

New kinds of vehicle theft

With the introduction of transponder or “smart keys” which have become increasingly sophisticated since their introduction in 1997, hot-wiring a car is no longer an option for thieves. As a result, they’ve discovered new ways to illegally gain access to vehicles including:

- Acquiring keys illegally through outright theft (from valet parking lots, for example) or by posing as legitimate vehicle owners seeking a replacement from a dealership or locksmith.

- Not returning rental vehicles. Although not as technical as other schemes, NICB has investigated cases where a rental vehicle will be returned with a good key in the ignition and a blank key along with it. The thieves then return to the rental lot later with the other good key and simply drive off with the car. Or, they will place a GPS tracker in the car and when it is re-rented, follow it to a destination and then steal it once it is parked.

- Fraudulent financing. In a new twist, thieves use stolen identities or even create completely fraudulent new ones with phony credit histories, then walk into new car dealerships and secure loans for high-end vehicles. The vehicles are then shipped to a foreign seaport where they can be sold at a premium.

- VIN switching. Not all vehicles stolen through fraudulent means are exported. Many undergo another form of identity theft by assuming the “clean” vehicle identification number (VIN) of an identical make and model in order to disguise their true identity and allow for resale to an unsuspecting consumer. Such disguises are known as VIN cloning, switching, or counterfeiting, depending on the specific techniques employed.

Before a dealer or locksmith makes a duplicate key for a customer, the customer must provide a vehicle’s registration or title information showing that the customer is, in fact, the owner of the vehicle. The NICB works with the National Automotive Service Task Force (NASTF) that has created a data exchange system that allows locksmiths and dealerships to access key codes and immobilizer reset information provided by automobile manufacturers.

NICB maintains a log of all NASTF transactions and NICB analysts examine the data looking for potential signs of fraud, as well as organized group activity resulting in numerous investigations.

Even with all the good news about the decline in vehicle theft, no vehicle is theft-proof. If yours is stolen, overcoming the loss can be a major hassle. Therefore, NICB still urges all vehicle owners to follow its “layers of protection” tips to help prevent their vehicle from being stolen.

Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800-TEL-NICB (800-835-6422), texting keyword “fraud” to TIP411 (847411) or submitting a form on our website. Or, download the NICB Fraud Tips app on your iPhone or Android device.

About the National Insurance Crime Bureau: headquartered in Des Plaines, Ill., the NICB is the nation’s leading not-for-profit organization exclusively dedicated to preventing, detecting and defeating insurance fraud and vehicle theft through data analytics, investigations, training, legislative advocacy and public awareness. The NICB is supported by more than 1,100 property and casualty insurance companies and self-insured organizations. NICB member companies wrote $371 billion in insurance premiums in 2013, or more than 78 percent of the nation’s property/casualty insurance. That includes more than 93 percent ($168 billion) of the nation’s personal auto insurance. To learn more visit www.nicb.org.

Twitter | Facebook | LinkedIn | YouTube | Blog

###

Contact:

Frank Scafidi

916.979.1510

[email protected]

Carol Kaplan

202.604.5649

[email protected]