Genworth Cost of Care Survey 2019: Skyrocketing care costs may make the dream of aging at home more challenging

Richmond, VA (October 16, 2019) -- The fastest-rising long term care costs are no longer for the most skilled care – in a facility, they’re now for the least-complex care – at home, according to Genworth’s latest 2019 Cost of Care Survey results, announced today.

To explore Cost of Care data by city, state or zip code, find trend charts and access lists of states ranked in order of care costs, visit www.genworth.com/costofcare.

Genworth Cost of Care Survey 2019: Skyrocketing care costs may make the dream of aging at home more challenging #CostOfCare2019 Tweet

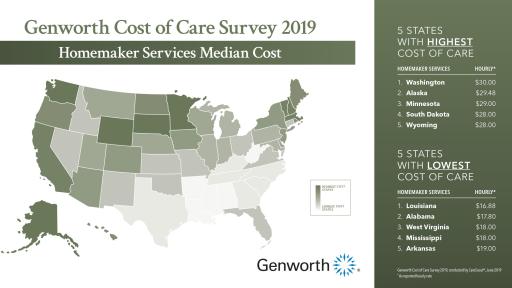

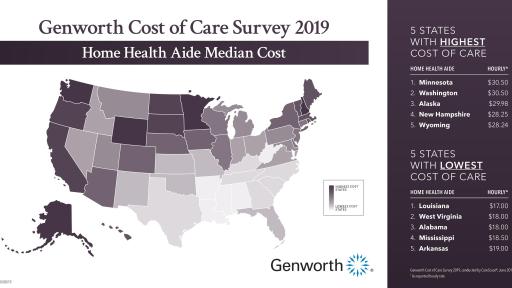

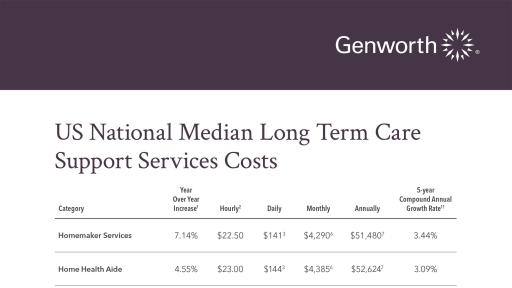

The cost of homemaker services, which includes assistance with "hands-off" tasks such as cooking, cleaning and running errands, has increased 7.14 percent in the last 12 months alone. The cost of a home health aide, which includes "hands-on" personal assistance with activities such as bathing, dressing and eating, has increased 4.55 percent.

Although the $51,480 national annual median cost of homemaker services1 is only about half the annual median cost of a nursing home, the cost of homemaker services rose almost four times as fast (7.14% vs 1.82%). That means even assistance with simpler, everyday tasks – often the only help needed to maintain independence at home -- is now more expensive than ever.

"Considering that most people want to stay in their homes as they grow older2 and 65-year- olds today have a 70 percent chance of needing some type of long term care services in their remaining years3, it’s evident that planning for how to pay for long term care is now more urgent than ever," said Gordon Saunders, Senior Brand Marketing Manager at Genworth who manages the Cost of Care Survey.

Accelerating home care costs are creating an affordability gap, particularly for middle-income Americans, said Nita Sommers, President of Honor, a San Francisco-based company that provides workforce management and technology expertise to independently owned home care agencies. "One of the biggest challenges is helping consumers adequately save for long term care, but we also need to look at innovation and what technologies we can utilize to help close that gap," she said.

Why Home Care Costs are Rising

Sommers and other providers say it’s a case of not enough care professionals to meet the increasing demand for in-home care. They point to several factors creating a perfect storm for the industry: 1) the tight labor market, 2) the costs of complying with the new mandates in local, state and federal certifications and regulations, including revised minimum wage and overtime laws in some states, and 3) the shift in post-acute Medicare reimbursement, which is spurring hospitals to discharge patients sooner and with greater care needs.

"We are addressing an unprecedented need among home-bound patients for non-medical care because we know that most seniors prefer to live at home for as long as possible and the aging U.S. population is booming," said Tafa Jefferson, founder and CEO of Amada Senior Care, based in Orange County, CA, which provides in-home senior care through corporate- and franchise-owned home care agencies in 39 states.

The U.S. Department of Labor projects the demand for home health aides and personal aides will increase 36 percent, from 3.2 million to 4.4 million, in the next 10 years4.

"Because of the tight labor market, the competition for care professionals is intense," Jefferson said. "Non-medical agencies are now competing with hospitals, assisted living facilities and other service-based industries by offering higher pay and benefits, which ultimately drives up the cost of providing in-home care services. Thanks to advancements in mobile technology and recruitment techniques, these highly sought-after care professionals have instant access and exposure to job offers, in many cases, up to three new opportunities a week," he said. "As a result, these mostly part-time workers may be working with multiple agencies, accepting jobs that best meet their schedules."

Adding to the cost of in-home care services are mandated minimum wage laws in some localities and a change in federal rules that require in-home care workers to be paid overtime, which is creating an increasingly complex operating environment to be able to keep up with growing demand for in-home care, Sommers and Jefferson noted.

Contributing to the demand for in-home care is a shift in post-acute Medicare reimbursement, they said. A change from a fee-based to value-based Medicare payment system has resulted in the reduction of skilled nursing days provided to patients following their release from a hospital. As a result, many patients are sent home with more acute care needs and costly care episodes often not covered by Medicare.

"The trends driving up the cost of care should be concerning to families," Jefferson said. "They should have the uncomfortable discussion about how they plan to finance long term care, something we’re all, unfortunately, going to have to address. If families do not have the resources or proper plan in place, by default, they will shoulder the responsibility of caregiving."

Said Honor’s Nita Sommers, "Ideally, families should save for long term care just like they save for college."

Costs Are Rising Across All Care Settings

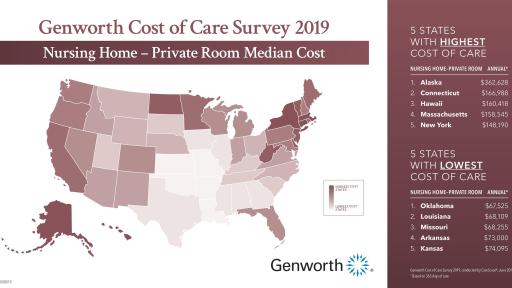

While home care costs increased the most year over year, adult day health care services followed close behind with a 4.17 percent increase. In contrast, the cost of care in facilities has stabilized during the past year with increases ranging from 1-2 percent for assisted living facilities and nursing homes.

The national annual median cost of care now ranges from $102,200 for a private room in a nursing home to $19,500 for adult day health care services (based on five days per week per year). A new category in this year’s Cost of Care Survey is in-home skilled nursing at a national median cost of $87.50 per visit. See accompanying chart for national median hourly, daily, monthly and annual costs for each care setting.

Genworth’s Cost of Care Planning Resources

"As an ally for people as they grow older, we offer our annual Cost of Care Survey and award- winning interactive website to help individuals and their families educate themselves about what to expect in terms of care costs so that they can begin planning well before they need it," said Genworth’s Cost of Care Survey Manager Gordon Saunders.

In addition to the Cost of Care calculator, Genworth’s website contains long term care planning tools, practical information on topics such as understanding Medicare and Medicaid, conversation starters, impairment simulations, options for financing long term care, and videos of real families sharing their long term care stories.

- To access 16-year Cost of Care trend charts, click here.

- To access tables ranking states from the highest to lowest cost in each care category, click here.

About Genworth Cost of Care Survey 2019

Genworth’s annual Cost of Care Survey, one of the most comprehensive studies of its kind, contacted 53,901 long term care providers nationwide to complete 15,178 surveys for nursing homes, assisted living facilities, adult day health facilities and home care providers. The survey includes 441 regions based on the Metropolitan Statistical Areas, defined by the Office of Management and Budget, and include approximately 85 percent of the U.S. population. CareScout®, part of the Genworth Financial family of companies, has conducted the survey since 2004. Located in Waltham, Massachusetts, CareScout has specialized in helping families find long term care providers nationwide since 1997.

About Genworth Financial

Genworth Financial, Inc. (NYSE: GNW) is a Fortune 500 insurance holding company committed to helping families achieve the dream of homeownership and address the financial challenges of aging through its leadership positions in mortgage insurance and long term care insurance. Headquartered in Richmond, Virginia, Genworth traces its roots back to 1871 and became a public company in 2004. For more information, visit genworth.com.

From time to time, Genworth releases important information via postings on its corporate website. Accordingly, investors and other interested parties are encouraged to enroll to receive automatic email alerts and Really Simple Syndication (RSS) feeds regarding new postings. Enrollment information is found under the "Investors" section of genworth.com. From time to time, Genworth's publicly traded subsidiaries, Genworth MI Canada Inc. and Genworth Mortgage Insurance Australia Limited, separately release financial and other information about their operations. This information can be found at http://genworth.ca and http://www.genworth.com.au.

Media Contact:

Julie Westermann

804.662.2423

[email protected]

1Based on 44 hours per week by 52 weeks

2AARP, 2018 Home and Community Preferences Survey: A National Survey of Adults Age 18-Plus, ©August 2018, https://www.aarp.org/research/topics/community/info-2018/2018-home-community-preference.html.

32019 U.S. Department of Health and Human Services, LongTermCare.gov., Oct. 10, 2017.

4Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, Home Health Aides and Personal Care Aides, https://www.bls.gov/ooh/healthcare/home-health-aides-and-personal-care-aides.htm, accessed Oct. 2, 2019.