Canadians who drive while high on marijuana believe they can do so safely

New State Farm® survey highlights concerns about impaired driving as federal government considers legalizing marijuana

CNW, Aurora, ON (May 17, 2016)

As federal politicians consider how to make good on Prime Minister Trudeau’s promise to legalize marijuana, it is clear that Canadians are concerned about how this will impact safety on our roads.

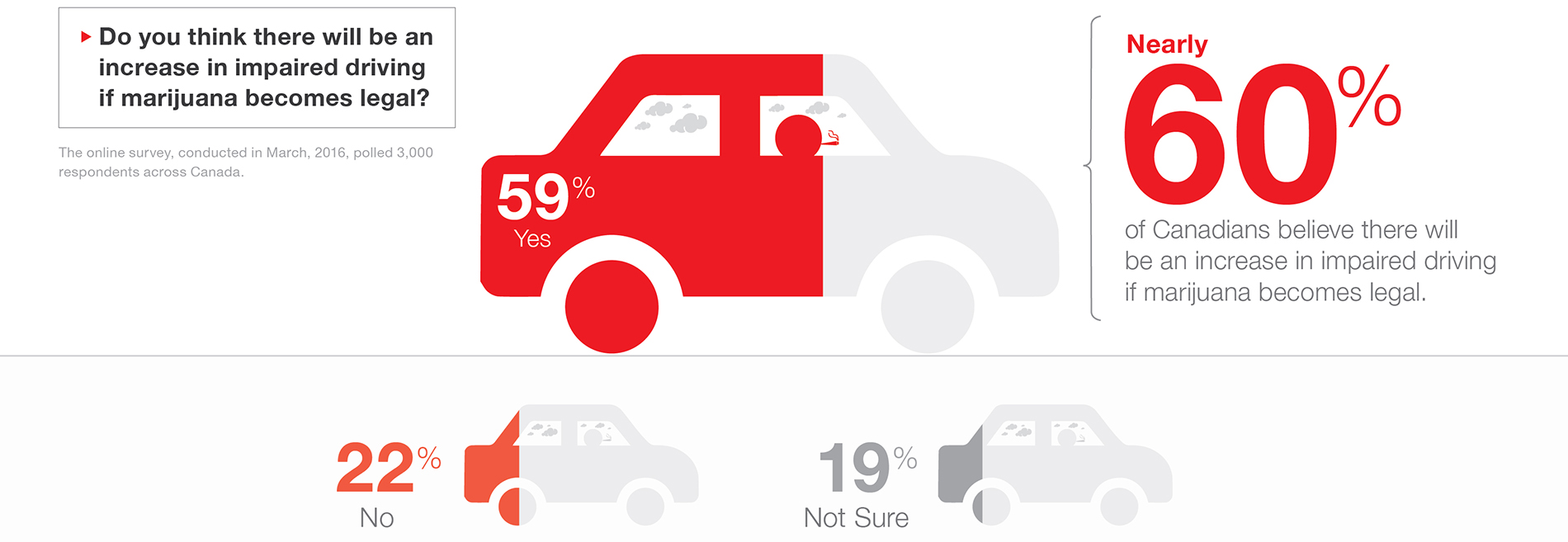

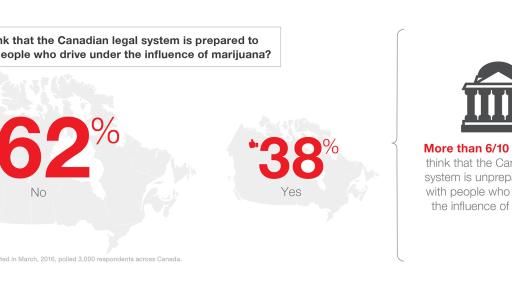

A new State Farm survey released today found that more than 60 per cent of respondents believe the legal system is unprepared to deal with people who drive under the influence of marijuana. And, close to the same number think there will be an increase in impaired driving if and when marijuana becomes legal.

While most Canadians agree that drinking and driving is dangerous, surprisingly, one out of four survey respondents don’t believe or don’t know that smoking marijuana and driving can be as bad. However, 80 per cent of Canadians believe that marijuana impaired drivers should face legal ramifications for driving while high.

“At a time when legislators and advisors are considering how to legalize marijuana it is clear that Canadians have questions and are concerned about an increase in impaired driving.” says John Bordignon, Media Relations, State Farm. “We know marijuana impairs judgement and reaction time, so any move to legalize it has to be matched with safeguards to discourage drivers from getting behind the wheel while they are influenced by it. Keeping our roads and streets safe must be a clear priority.”

Marijuana impaired driving

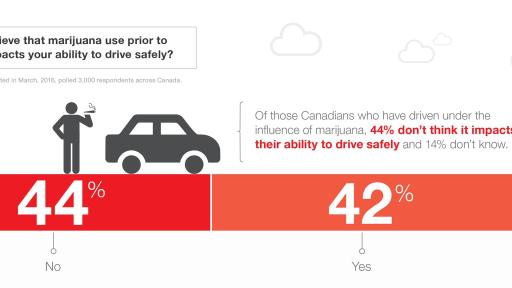

How prevalent is marijuana impaired driving on our streets? It might be comforting to hear that almost nine out of 10 respondents say they have never driven under the influence of marijuana. However, some that do drive high, believe it is harmless. Forty-four per cent say it doesn’t impact their ability to drive safely, an additional 14 per cent are unsure.

Additionally, nine out of 10 respondents feel that younger drivers, aged 16-34, are the most likely to drive under the influence of marijuana.

According to research by the Traffic Injury Research Foundation (tirf.ca) here is a breakdown, by age group, of fatally injured drivers whose blood tested positive for marijuana in 2012:

- 28.5% - 16 to 34

- 21.1% - 35 to 49

- 10.6% - 50 to 64

- 1.3% - 65 and over

When asked what would make them stop driving high, 20 per cent of survey respondents say that there is nothing that would make them stop driving while under the influence, four out of 10 think that stiffer penalties would deter them followed by more public awareness. That said, more than 50 per cent don’t think that police have the tools and resources necessary to identify marijuana impaired drivers.

Prescription and over-the-counter drugs

The survey surprisingly uncovered that about 25 per cent of respondents admit they ignore prescription or over-the-counter drug labels that recommend not driving while on the medication all or some of the time. Still, nine out of 10 respondents indicated that they do not drive while on a prescription or an over-the-counter drug that recommends against driving.

Similar to marijuana, 61 per cent of Canadians think prescription drug-impaired driving is a problem for younger drivers aged 16 to 34.

Additional Resources

This is the first of three news releases State Farm will distribute in 2016 revealing survey results and the opinions of Canadians about their driving habits and road safety.

State Farm also took to the streets to ask Canadians their thoughts about marijuana impaired driving. To see what they had to say, please see above videos. For specific reactions in Toronto, Saint John, Ottawa and Calgary, please contact [email protected].

To find out more about how State Farm works to improve road safety in Canada, please visit https://www.statefarm.ca/about-us/community/safety-awareness/auto-safety

About the Survey

The online survey, conducted in March, 2016, polled 3,000 respondents of driving age across Canada.

About State Farm:

In January 2015, State Farm’s Canadian operations were purchased by Desjardins Group, the leading cooperative financial group in Canada and among the three largest P&C insurance providers in Canada. With its 500 dedicated agents and 1700 employees, the State Farm division provides insurance and financial services products including mutual funds, life insurance, vehicle loans, critical illness, disability, home and auto insurance to customers in Ontario, Alberta and New Brunswick. For more information, visit www.statefarm.ca, join us on Facebook – www.facebook.com/statefarmcanada , or follow us on Twitter – www.twitter.com/statefarmcanada

®State Farm and related trademarks and logos are registered trademarks owned by State Farm Mutual Automobile Insurance Company, used under licence by Certas Home and Auto Insurance Company and certain of its affiliates.

©Copyright 2016, Certas Home and Auto Insurance Company.

-30-

For more information, please contact:

Ginger Shewell

Media Profile

[email protected] / 416-342-1802

John Bordignon

State Farm Canada

[email protected]

905-750-5567/416-801-6078