The current student loan debt crisis in the U.S. is real. Total student loan debt currently stands at more than $1.16 trillion. And, according to the Federal Reserve Bank of New York, student loans represent the highest amount of delinquent debt compared to all other forms of household debt, including mortgages, auto loans, and credit cards.

Multimedia

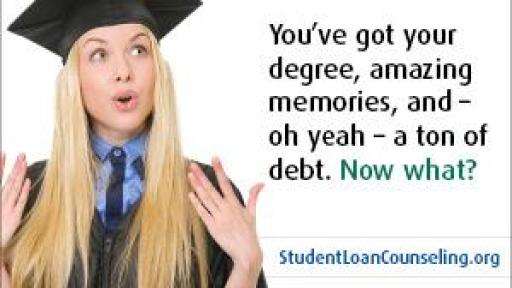

Gaining a college education has long been among the most important first steps towards obtaining a happy and prosperous life. The reality, however, is that most college graduates are starting their adult life deep in debt, and feeling stressed and completely unprepared to manage their financial lives. The good news is that the government has created programs to help borrowers reduce the burden caused by student loan debt. To learn more about these government programs, visit StudentAid.ed.gov.

Money Management International (MMI), along with other nonprofit organizations and consumer advocate groups, have taken additional steps to help struggling student loan borrowers understand their repayment plan options, find solutions for managing other debt obligations, and create realistic action plans for reaching overall financial success.

With so many new programs and valuable resources available, anyone with student loan debt, regardless of their ability to pay, is encouraged to take steps to understand their repayment options. Help is available. With a manageable repayment, borrowers can pay back all debt obligations and take steps toward long-term financial success.

To participate in a personalized one-on-one counseling session with a student loan counselor at MMI, call 866.864.8995 or visit StudentLoanCounseling.org.

Valuable help with student loans is just a click away

About Money Management International

Money Management International (MMI) is a nonprofit, full-service credit-counseling agency, providing confidential financial guidance, financial education, counseling and debt management assistance to consumers since 1958. MMI helps individuals and families deal with unmanageable debts and improve overall financial health through personalized one-on-one counseling programs, including debt and budget, foreclosure prevention, student loans, credit report review, and bankruptcy. Most counseling is available by appointment in branch offices and 24/7 by telephone and Internet. Services are available in English or Spanish. To learn more, call 866.864.8995 or visit MoneyManagement.org.

Contact:

Tanisha Smith

Media Relations

[email protected]