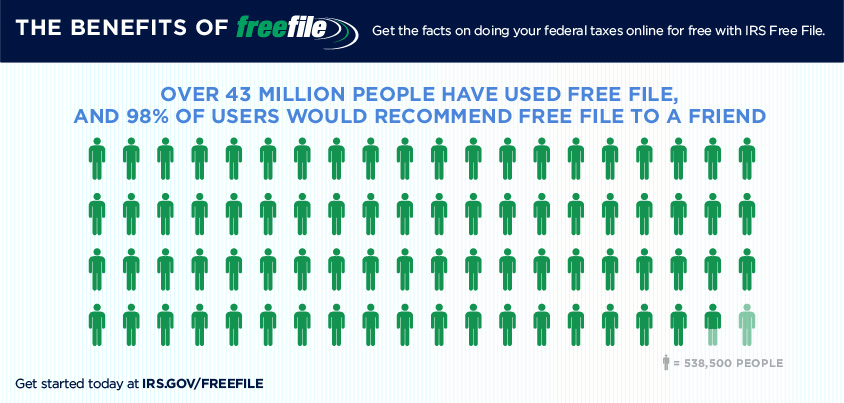

Welcome to IRS Free File. It's fast. It's safe. It's free.

Available 24/7 on IRS.gov/freefile, everyone can use Free File whenever it’s convenient for them. Tweet People who make $60,000 or less – that’s 70 percent of all taxpayers—can use brand–name software to file their taxes for free!

Free File is made available through a public–private partnership between the IRS and the Free File Alliance, a consortium of approximately 14 tax preparation software providers. Each provider sets its own eligibility rules but anyone earning $60,000 or less can find a software program.

With its easy–to–use Q&A format, IRS Free File finds the right forms, does the math and helps you find tax breaks you might overlook, such as the Earned Income Tax Credit. This year, IRS Free File even helps you understand how the health care law affects your tax return.

People who make more than $60,000 a year can use Free File Fillable Forms, the electronic version of IRS paper forms. These online fillable forms are best for people experienced doing their own taxes. The forms perform basic math functions. The program does not support state income tax returns.

By using free IRS e—file and direct deposit, you can get your federal refund in as few as 10 days. Get started now by going to www.irs.gov/freefile.

Contact Information:

Nancy Mathis

[email protected]

240-613-6143