CoreLogic US Home Price Report Shows Home Prices Up Almost 7 Percent Year Over Year

—Forecast Projects Increase of More Than 4 Percent by August 2016—

PR Newswire, IRVINE, Calif., October 6, 2015

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled services provider, today released its CoreLogic Home Price Index (HPI) and HPI Forecast data for August 2015 which shows home prices are up both year over year and month over month.

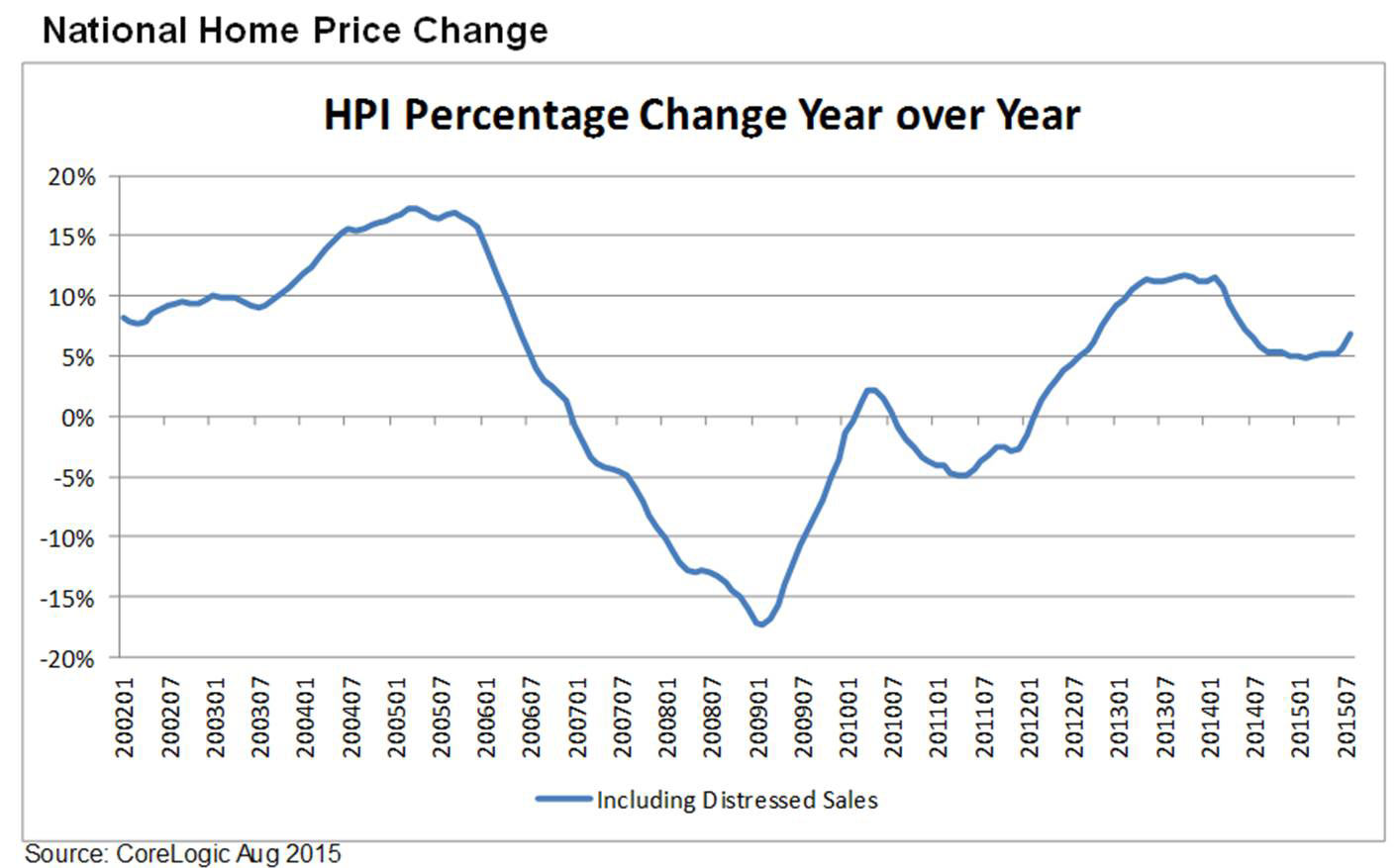

According to the CoreLogic HPI, home prices nationwide, including distressed* sales, increased by 6.9 percent in August 2015 compared with August 2014 and increased by 1.2 percent in August 2015 compared with July 2015.**

The CoreLogic HPI Forecast indicates that home prices are projected to increase by 4.3*** percent on a year-over-year basis from August 2015 to August 2016 and remain unchanged month over month from August 2015 to September 2015. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Economic forecasts generally project higher mortgage rates and more single-family housing starts for 2016. These forces should dampen demand and augment supply, leading to a moderation in home price growth,” said Frank Nothaft, chief economist for CoreLogic. “Over the next 12 months through August 2016, CoreLogic projects its national HPI to rise 4.3 percent, less than the 6.9 percent gain over the 12 months through August 2015.”

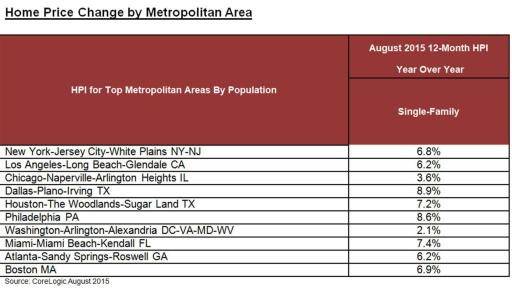

“Home price appreciation in cities like New York, Los Angeles, Dallas, Atlanta and San Francisco remain very strong reflecting higher demand and constrained supplies,” said Anand Nallathambi, president and CEO of CoreLogic. “Continued gains in employment, wage growth and historically low mortgage rates are bolstering home sales and home price gains. In addition, an increasing number of major metropolitan areas are experiencing ever-more severe shortfalls in affordable housing due to supply constraints and higher rental costs. These factors will likely support continued home price appreciation in 2016 and possibly beyond.”

August National Home Price Change

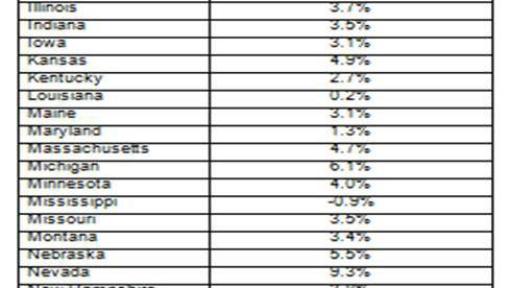

August Home Price Change By State August Home Price Change By Top Metropolitan Area By Population*The home price data in this release includes distressed sales. Requests for home price data excluding distressed sales may be directed to the contacts below.

**July data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

***The forecast accuracy represents a 95-percent statistical confidence interval with a +/- 2.0 percent margin of error for the index.

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing, and securities real-estate databases and incorporates more than 30 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with a five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends among Single-Family Attached and Single-Family Detached properties. The indexes are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are based on a two-stage error-correction structural model that combines the equilibrium home price—as a function of real disposable income per capita—with short-run fluctuations caused by market momentum, mean-reversion, and exogenous economic shocks like changes in the unemployment rate. With a five-year forecast horizon, CoreLogic HPI Forecasts project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales. As a companion to the CoreLogic HPI Forecasts, Stress-Testing Scenarios align with Comprehensive Capital Analysis and Review national scenarios to project home prices under baseline, adverse and severely adverse scenarios at state, CBSA and ZIP Code-levels.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Lori Guyton at [email protected] or Bill Campbell at [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled services provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, CoreLogic HPI, CoreLogic HPI Forecast and HPI are trademarks of CoreLogic, Inc. and/or its subsidiaries.

For real estate industry and trade media:

Bill Campbell

[email protected]

212-995-8057

For general news media:

Lori Guyton

[email protected]

901-277-6066

###