CoreLogic Reports National Home Prices Rose by 6.5 Percent Year Over Year in June 2015

—Home Prices Projected to Increase by 4.5 Percent Year Over Year by June 2016—

PR Newswire, IRVINE, Calif., August 4, 2015 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled services provider, today released its June 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 6.5 percent in June 2015 compared with June 2014. This change represents 40 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 1.7 percent in June 2015 compared with May 2015*.

Including distressed sales, 35 states and the District of Columbia were at or within 10 percent of their peak prices in June 2015. Fifteen states and the District of Columbia reached new price peaks—Alaska, Arkansas, Colorado, Hawaii, Iowa, Kentucky, Nebraska, New York, North Carolina, North Dakota, Oklahoma, South Dakota, Tennessee, Texas and Wyoming. The CoreLogic HPI begins in January 1976.

Excluding distressed sales, home prices increased by 6.4 percent in June 2015 compared with June 2014 and increased by 1.4 percent month over month compared with May 2015. Excluding distressed sales, only Massachusetts (-1.5 percent) and Louisiana (-0.1 percent) showed year-over-year depreciation in June. Distressed sales include short sales and real estate-owned (REO) transactions.

The CoreLogic HPI Forecast indicates that home prices, including distressed sales, are projected to increase by 0.6 percent month over month from June 2015 to July 2015 and by 4.5 percent** on a year-over-year basis from June 2015 to June 2016. Excluding distressed sales, home prices are projected to increase by 0.5 percent month over month from June 2015 to July 2015 and by 4.2 percent** year over year from June 2015 to June 2016. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The tightness of the for-sale inventory varies across cities. Throughout the U.S., the months’ supply was 4.8 months in the CoreLogic home-listing data for June, but varied greatly across cities. In San Jose and Denver, there was only 1.6 months’ supply of homes on the market, whereas Philadelphia had a 7 months’ supply and Providence had a 6.6 months’ supply,” said Frank Nothaft, chief economist for CoreLogic. “The stronger appreciation was registered in cities with limited inventory and strong homebuyer activity, such as San Jose and Denver.”

“The current cycle of home price appreciation is closing in on its fourth year with no apparent end in sight,” said Anand Nallathambi, president and CEO of CoreLogic. “Pent-up buying demand and affordability, together with higher consumer confidence buoyed by a more robust labor market, are a potent mix fueling a 6.5 percent jump in home prices through June with more increases likely to come.”

Highlights as of June 2015:

- Including distressed sales, the five states with the highest home price appreciation were: Colorado (+9.8 percent), Washington (+8.9 percent), New York (+8.3 percent), South Carolina (+8 percent) and Nevada (+8 percent).

- Excluding distressed sales, the five states with the highest home price appreciation were: Colorado (+9.3 percent), New York (+8.5 percent), Washington (+8.3 percent), Oregon (+8.2 percent) and Nevada (+7.9 percent).

- Including distressed sales, only four states experienced home price depreciation: Massachusetts (-5 percent), Connecticut (-0.6 percent), Louisiana (-0.4 percent) and Mississippi (-0.3 percent).

- Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to June 2015) was -7.4 percent. Excluding distressed transactions, the peak-to-current change for the same period was -4 percent.

- The five states with the largest peak-to-current declines, including distressed transactions, were: Nevada (-32.2 percent), Florida (-28.7 percent), Rhode Island (-26.5 percent), Arizona (-25.8 percent) and Maryland (-21.2 percent).

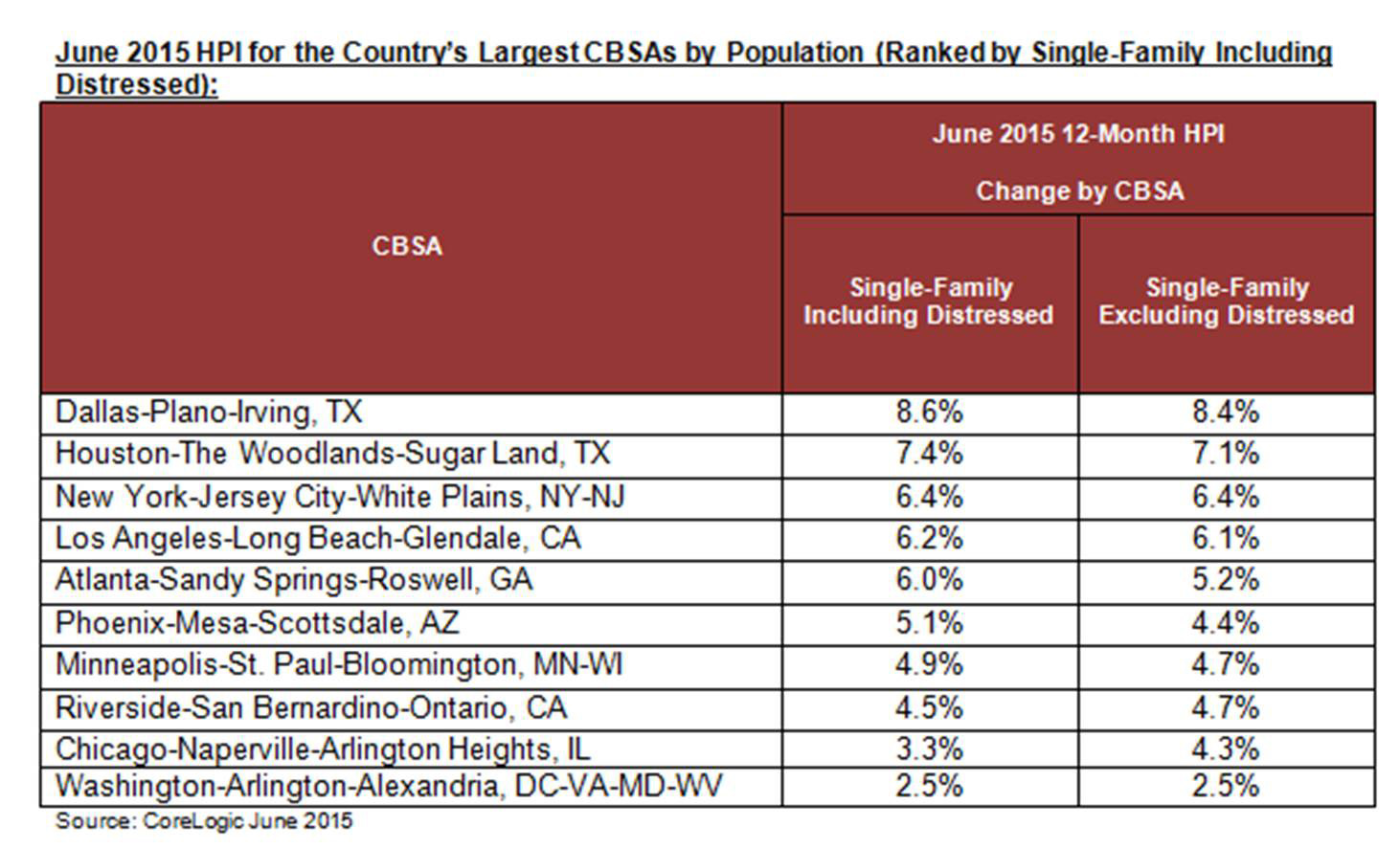

- Of the top 100 Core Based Statistical Areas (CBSAs) measured by population, 93 showed year-over-year increases. The seven CBSAs that showed year-over-year declines were: Baltimore-Columbia-Towson, MD (-8 percent); Boston, MA (-4.4 percent); Camden, NJ (-0.5); Hartford-West Hartford-East Hartford, CT (-0.1 percent); New Haven-Milford, CT (-1.8); New Orleans-Metairie, LA (-6.1 percent) and Worcester, MA-CT (-7 percent).

*May data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

**The forecast accuracy represents a 95-percent statistical confidence interval with a +/- 2.0 percent margin of error for the index including distressed sales and a +/- 2.0 percent margin of error for the index excluding distressed sales.

June National and State HPI (Ranked by Single Family Including Distressed)

Figure 1: Home Price Index Percentage Change Year Over Year

Figure 2: YoY HPI Growth for 25 Fastest-Appreciating States Min, Max, Current Since January 1976

Methodology

The CoreLogic HPI™ incorporates more than 30 years’ worth of repeat sales transactions, representing more than 65 million observations sourced from CoreLogic industry-leading property information and its securities and servicing databases. The CoreLogic HPI provides a multi-tier market evaluation based on price, time between sales, property type, loan type (conforming vs. nonconforming) and distressed sales. The CoreLogic HPI is a repeat-sales index that tracks increases and decreases in sales prices for the same homes over time, including single-family attached and single-family detached homes, which provides a more accurate “constant-quality” view of pricing trends than basing analysis on all home sales. The CoreLogic HPI provides the most comprehensive set of monthly home price indices available covering 7,319 ZIP codes (60 percent of total U.S. population), 663 Core Based Statistical Areas (89 percent of total U.S. population) and 1,297 counties (86 percent of total U.S. population) located in all 50 states and the District of Columbia. Forecast ranges provided in this report are based on a 95 percent confidence interval.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Lori Guyton at [email protected] or Bill Campbell at [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled services provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, CoreLogic HPI, CoreLogic HPI Forecast and HPI are trademarks of CoreLogic, Inc. and/or its subsidiaries.

For real estate industry and trade media:

Bill Campbell

[email protected]

212-995-8057

For general news media:

Lori Guyton

[email protected]

901-277-6066

###